The publication of the South African Broadcasting Corporation’s (SABC) 2017 Annual Report reveals few surprises to those attending last week’s Southern Africa Broadcasting Association (SABA) conference in Windhoek.

Hosted by the Namibian Broadcasting Corporation (NBC), many of the discussions were focused on the future of public broadcasting in the SADC region. Although public service broadcasters (PSBs) face many challenges, from the continued growth of external media players operating in the region to a decline in income from advertising and sponsorship, the SABC Annual Report also highlights the opportunities available to PSBs in southern Africa.

The first is positioning. These national media houses are established and recognisable brands but they do need to innovate. As quoted in Screen Africa’s coverage of SABC’s Annual Report, the broadcaster continued to dominate the broadcasting landscape with its five television channels attracting, on average, 28.8 million (SABC1), 26.9 million (SABC2), 21 million (SABC3), 2.2 million (SABC News) and 1.4 million (SABC Encore) viewers in a typical month. Seventeen of the nation’s Top 20 television programmes are carried on the SABC.

Much discussed in Windhoek was the need to nurture and commission local content. Audience relevance is critical and it is not so easy for the global digital giants to provide engaging local content. SABC has also made a clear step in this direction by broadcasting more local content offerings.

But innovation remains the critical step for many PSBs in southern Africa. This is not primarily about the switch from analogue to digital broadcasting but more about operating strategically in a multiplatform world i.e. ‘inviting in’ new audiences by integrating multiplatform social media.

There is still much talk of an SADC/SABA “Bouquet” or channel where content is shared between SADC broadcasters. However, solid first steps would be for one or two key players in the region to begin to innovate and share in the multiplatform arena.

Despite its problems, SABC is still well placed to lead across the region. PMA’s Finance Manager, Mervyn Warner, make’s a more detailed assessment of its 2017 Annual Report below.

SABC Annual Report

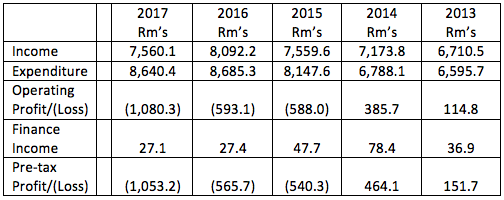

The recent SABC Annual Report covers its financial performance for the year ending 31 March 2017. Given the much publicised internal and management issues faced by SABC during this particular period the reported pre-tax deficit of R1,053.2m was not unexpected and adds to deficits of R565.7m – 2016 and R540.3m – 2015.

Historic analysis of SABC’s financial results reveals performance issues which pre-date the current year. Prolonged instability at SABC Board and senior management level will have impacted on robust, continuous, strategic and financial decision making. The result becoming apparent both in operational performance and financial controls and deficiencies highlighted in the annual report by SABC’s Chairperson, Group Chief Executive Officer and the Auditor-General.

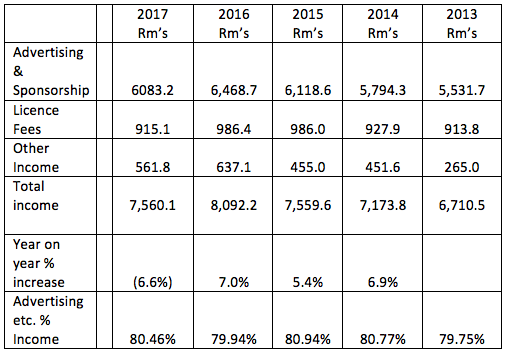

Key within this is SABC’s funding model which predominantly relies on advertising and programme sponsorship as the cornerstone for funding.

Advertising and sponsorship revenue which had seen substantial annual growth between 2013 and 2016 (16.9% over 4 years) slumped in 2017 with a year-on-year reduction of 5.95%. Given changes in the media landscape, audience viewing expectations and increasing competition from digital platforms, the idea of continued growth in advertising revenue is unrealistic. Underlying reductions in 2017 advertising revenue receipts and continuing future pressures can be partially explained by a number of market factors with some local elements exacerbating the effect:

· Advertising revenue and audiences transferring to or being diluted by increased competition by digital platforms. Netflix launched in South Africa in January 2016. This challenge is not unique to SABC as CBC/Radio-Canada’s 2017 Annual Report recently referred to changes in its market as: “A structural shift is happening as advertisers are increasing their spending online where American digital companies dominate. This poses a significant challenge to traditional broadcasters that continue to offer high-quality programs while the value attributed to these offerings is in decline. Traditional advertising streams that fund Canadian programs are declining, and those streams are moving to new competitors: large, global companies like Facebook and Google that have established dominant positions in the Canadian market yet are not required to contribute to support the system”

· The question of whether expensive “event television” or prime sports events continue to attract sufficient levels of advertising comparative to the remainder of the schedule to warrant the disproportionate year-on-year increased level of cost.

· Delay in embracing alternative delivery platforms as a way of maintaining audience demographic and reach.

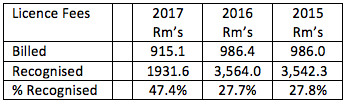

Licence fees continue to show a disappointing collection rate of 47.4%, in 2017 (27.7% in 2016 & 27.8% in 2015). This position is unlikely to improve as VOD and OTT providers expand their offers to South African viewers and audiences seek premium content by subscribing to the OTT and VOD services.

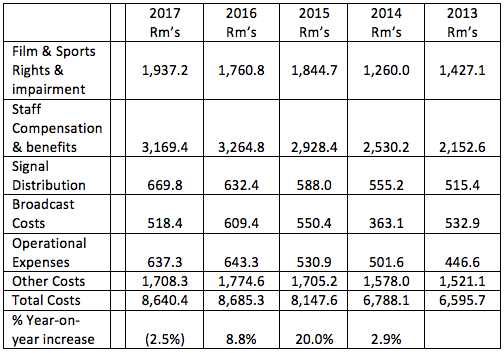

Revenue generation is not the sole challenge to SABC. A longer-term review of historic performance highlights substantial increases in its cost base, which are not commensurate with income growth. Analysis of annual financial performance reveals substantial cost Increases between 2013 and 2017.

Film and sports rights are major contributors to SABC’s costs (22.4% in 2017), which has shown major sustained increase since 2014. While some of this can be accounted for in the global increase in fees for major sporting events, further analysis of the broadcast schedule may highlight genres that are showing diminishing returns between cost and advertising revenue. Even though SABC must continue to offer a balanced schedule and meet its broadcast obligations, a review could prompt a decision by SABC that it is no longer viable to compete with the commercial sector for specific major sports and events, international film rights or other prime genres.

Elsewhere, staff compensation and benefits (36.7% of cost in 2017), having shown some reduction in 2017 (2.9%), has again seen substantial year-on-year increases between 2013 and 2016, while signal distribution, broadcast and operational costs continue to increase. This may be partially driven by technology and moves into other platforms such increases are not sustainable in the longer term.

Even though historic governance and financial short comings need to be resolved and new processes and safeguards introduced, this must

not distract from improving the broadcaster’s future financial performance. SABC has prepared a budget for 2017/18 on the basis of a break-even position. But even if this is achieved it is difficult, without a major influx of cash from the South African government, to see how this will resolve the underlying problem of SABC being unable to settle its debts. Management’s target must be a surplus to start to redress its weak financial position. Timely reporting is therefore of the essence to identify changes in revenue projections as early as possible thereby giving maximum opportunity for it to react to and exploit any positives whilst negating shortfalls with planned and managed changes to the organisation’s cost base.